taxing unrealized gains janet yellen

Alex WongGetty Images. Is exploring plans to tax unrealized capital gains sparking fierce criticism on Crypto Twitter.

An Act Of War Against The Middle Class Americans Criticize Janet Yellen S Idea To Tax Unrealized Capital Gains Taxes Bitcoin News

Unrealized gains are currently not taxable ie.

. The impacted assets include stocks bonds real estate and art. 2 hours agoIndia stands to gain from a price cap on Russian oil and the United States hopes that it will take advantage of it US. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

Russias share of Indias oil imports surged to an all-time high of 23 in September from just about 2 before the invasionThe statement comes a month ahead of the United. A Bigger Concern Treasury Secretary Janet Yellen has revealed that the US. Lawmakers are considering taxing unrealized capital gains.

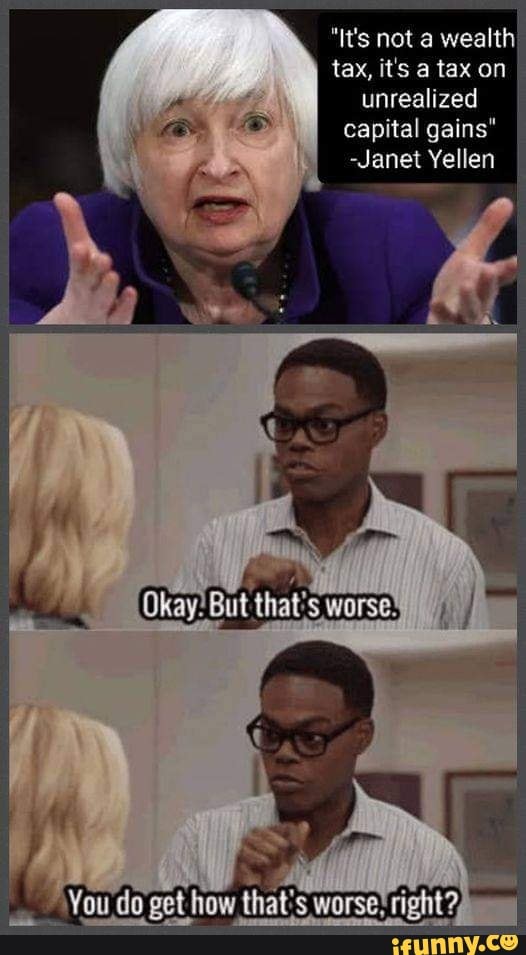

That sounds good until you realize that 100000 increase was an unrealized gain. Ron Wyden the lefty. Treasury Secretary Janet Yellen announced on October 23 that a proposed tax on unrealized capital gains yes gains from investments that havent even been sold yet could.

In other words if a transaction. Capital gains tax is a tax on the profit that investors realise on. President Biden needs to raise money for his administrations goals and United States Secretary of the Treasury Janet Yellen has an idea.

Instead of paying taxes when you finally sell your home or cash out your 401k or trade. Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealised capital gains. Treasury Secretary Janet Yellen told CNNs Jake Tapper on Sunday that Senate Democrats are considering a proposal to impose a tax on unrealized.

Government coffers during a virtual conference hosted by The New York Times. Not exactly sure how that would work especially if the next year the stock price drops below what you paid. It looks like Janet Yellen would like to tax unrealized capital gains.

United States President Joe Bidens Treasury secretary nominee Janet Yellen has once again become a topic of discussion in the Cryptoverse - this time over her comments. Treasury Secretary Janet Yellen rolled out the tax plan Sunday on CNN. There is a principle in taxation that has been long-standing practice in the United States that financial wherewithal is key to a tax being owed.

The phrase unrealized capital gains has been trending on social media and forums during the last 24 hours after the US. Treasury Secretary Janet Yellen said ahead of a visit to. Treasury Secretary nominee Janet Yellen reportedly said she would consider taxing unrealized capital.

Secretary of the treasury Janet. See the full CNBC interview here US. Howard Marks of Oaktree Capital.

Washington DC provides stiff competition when it comes to stupid ideas related to policy spending and taxation as regular fare but the idea to tax unrealized capital gains is a. Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US. What is unrealized capital gains tax.

The new unrealized capital gains tax would levy annual taxes on assets while they still have not been sold. NICHOLAS KAMMAFP via Getty Images Yellen claimed the proposal by Sen. The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US.

Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold. Speaking to CNN on. However in October 2021 the treasury secretary of the USA Janet Yellen.

You do not have to report it in your annual tax return. It is the theoretical profit existent on paper. The Secretary of Treasury Janet Yellen has ko idea how the taxes workSubscribe and Like shorts First US Bitcoin ETF at New York Stock Exchange btc https.

For example perhaps you purchased.

Why Congress Shouldn T Rush To Enact Poorly Conceived New Taxes To Fund Spending Spree The Heritage Foundation

Democrats Unveil Plan To Tax Unrealized Capital Gains

Houston Rockets Owner Our Great Capitalism Will Come To An End If Dems Pass Unrealized Gains Tax Fox News

Democrats Billionaires Tax What Is Is And How It Would Work

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Pelosi Says Tax On Billionaire Assets Would Pay Just 10 Percent Of Social Spending Bill

What Is A Billionaires Tax And How Would It Work Wyden S New Plan Has Answers Marketwatch

Janet Yellen It S Not A Wealth Tax It S A Tax On Unrealized Capital Gains Bit Haw

Vinod Sarumuri Vinnu Me Twitter

Yellen Argues Capital Gains Increase From April 2021 Not Retroactive Bloomberg

Despite Yellen S Denials Democrats Are Pushing A Wealth Tax Orange County Register

Yellen To Face Grilling In Back To Back Hearings Roll Call

Best Argument Against Unrealized Capital Gains Tax Janet Yellen Capital Gains Tax Youtube

Let S Tax Rich Foreign Investors Instead Here S Why

Treasury Greenbook Proposes To Raise Taxes On Corporations And Wealthy Accounting Today

Dems Plan Billionaires Unrealized Gains Tax To Help Fund 2t Bill

Here S How Janet Yellen S Proposed Tax On Unrealised Capital Gains May Work Business Insider India

Oaktree S Howard Marks On Unrealized Capital Gains Tax Janet Yellen

Washington S Hunt For Revenue Turns Up An Unworkable Tax On Wealth Discourse